It’s been apparent for the last few years that audience viewership in TV is declining and people spend less and less time watching TV programming in favor of their mobile phones and PC. However, we’re still seeing an exponential trend in online videos, esp. with the popularity of online channels such as YouTube, Twitch and iTunes.

The Philippines is fairly new to this but the sudden and amazing success of music streaming service Spotify has sparked a lot of investment in internet TV in the country.

Here are the local players we know so far.

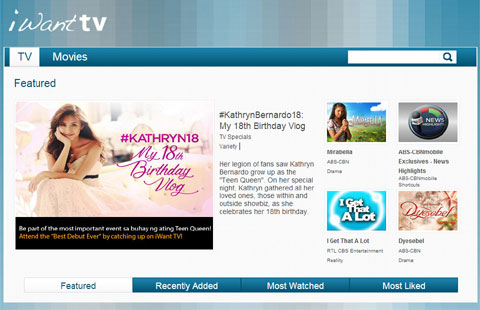

iWant TV! is perhaps one of the first video-on-demand and live streaming service that syndicates a lot of the TV shows from ABS-CBN and ABS-CBN Sports+Action, as well as Korean dramas and cable channels. Users can also watch foreign shows from NatGeo, the Food Channel, E!, CNN and Cartoon Network.

Its biggest draw to the usual TV viewers is the ability to watch regular TV programs at a later time (as shown in many of their commercials and TV ads). One can look at it as something similar to TiVo. The target audience are those who have regular office hours or are always on the field and have no access to TV during work hours.

The service is free to current subscribers of Sky Cable, Sky Broadband, BayanDSL or Bayan Broadband.

ClickPlay is a local start-up which was founded sometime 3 years ago and was heavily supported by Samsung and PLDT. PLDT Fibr, myDSL, and Telpad access to over 200 movies like Harry Potter, Lord of the Rings, The Dark Knight, The Matrix, and Inception.

PLDT Fibr subscribers get free movies based on their subscription plan.

* Plan 3500 subscribers get three free movies

* Plan 5800 subscribers get four free movies

* Plan 8800 subscribers get 10 free movies

* Plan 20,000 subscribers get 20 free movies

Blink started around 2 years ago and positioned itself as a streaming TV and movie rental service. It was heavily supported by Smart and offers unlimited monthly viewing of its catalog for only Php250.

Individual movie rentals are at Php90 for new movies and Php60 for older ones.

Video streaming service Hooq was introduced back in February. It is backed by Globe’s parent company, Singtel, has a stake in Hooq and even borrowed Globe’s chief adviser to become its CEO.

Subscription starts at Php199 a month for GoSurf and Tattoo Postpaid plan subscribers while non-subscribers will have to fork a higher monthly fee. It has a catalog of over 10,000 movies and TV episodes. ABS-CBN Broadcasting Corporation, GMA Network, Viva Entertainment and Regal Films have partnered with HOOQ to provide local content.

iFlix is a relatively newer player which positions itself to be the Netflix in SEA. Smart parent company, PLDT, has invested $15 million into the company to get an exclusive foothold in the Philippines.

Subscription is also lower at just Php129 per month with a 14-day free trial for first-time users. Smart subscribers are also given a special limited-time discount of only Php99 a month, under-cutting Hooq by 50%.

The question remains…

Will all these online video streaming and internet TV services currently available, will a significant number of Filipinos adopt and pay for it?

PLDT has invested a huge amount of resources into a lot of these services — ClickPlay, Blink and iFlix. All three are obviously overlapping services so it’s obvious PLDT wants to be the pipe for all these and increase usage (more bandwidth -> more revenue).

Are there enough titles in the catalog? Depending on how voracious a TV viewer you are, it could be enough.

How fresh the catalog is. Unless we get to see our favorite TV series within a week of its cable or TV broadcast, waiting for a couple of months or an entire season before you get to watch it seems uninteresting.

How good is the experience? Video quality and stream consistency (buffering) will be key factors that affect user experience.

How about the data cap? This could be one of the more serious obstacles that service providers will need to clarify. The fear of data cap will prevent a lot of interested users to avoid it. In the long run, users could be doubled-billed (cost of subscription plus cost of data usage).

Based on the current crop of video-on-demand services above, the biggest hurdle for them is “freshness” of content. Otherwise, the demographics that they will eventually attract are “discoverers” (those who look for new shows, perhaps in its 1st or 2nd season, they’d be interested to follow) and “sentimental” viewers who want to occasionally watch a re-run of their favorite movie or TV series.

However, the majority of those who religiously follow the current line-up of TV series each and every week will have to watch them somewhere else.

The post Will Internet TV save the declining TV viewership? appeared first on YugaTech | Philippines, Tech News & Reviews.