Aside from President Xi Jinping, another APEC guest from China is stirring interest.

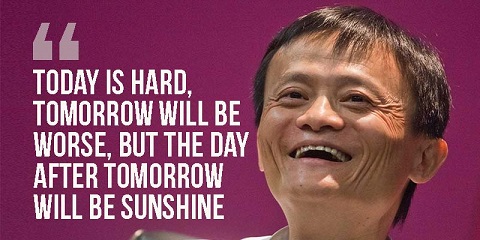

He is Jack Ma, founder and chairman of the Alibaba Group, the largest marketplace in the world which is expected to be worth over $150 Billion by next year, according to Forbes.com.

Ma is the second richest man in China (Forbes: $28.7 billion) and is the 18th richest man in the world.

He will be one of the speakers in the APEC2015 CEO Summit to be held on Nov. 16 to 18 at the Makati Shangrila in Makati.

Chaired by Jollibee Foods’ Tony Tan Caktiong, the 2015 APEC CEO summit expects to gather some 700 chief executive officers from across the Asia Pacific region to discuss under the theme “Creating the Future: Better, Stronger, Together.”

The CEOs will be meeting the 21 Leaders of APEC morning of Nov. 18.

Foreign Undersecretary Lula del Rosario, chair of the APEC 2015 Senior Officials Meetings that did the spadework for the Foreign Ministers and the Leaders, cites Ma as an example of the changes in the global economy which APEC tackles.

“Look at Jack Ma,” del Rosario said. “He sells goods that he does not own. What he has is Platform. That’s how your get your customer.”

Ma shared the strategy that made the Alibaba Group a huge success. He said he once told a Walmart (an American multinational retail corporation that operates a chain of discount department stores and warehouse stores) executive that Alibaba would surpass them in sales in 10 years and explained why.

“If you want 10,000 new customers you have to build a new warehouse and this and that. For me: two servers,” Ma was quoted to have said.

Del Rosario said in a borderless economy fueled by the internet, other issues come up like taxation and that’s where changes in policies and laws are needed. Transition is facilitated when it is discussed by persons who can make the decision, she said.

The story of the Alibaba Group’s dazzling success (its 21.8 billion IPO in New York in 2014 set a record as the world’s biggest public stock offering) is as fascinating as the story of its founder.

Born on September 10, 1964 in Hangzhou, about two hours’ drive from Shanghai, Ma was an English teacher. He improved his English by working as tourist guide for local hotels for free.

It’s interesting to know that the man who earned his wealth in an internet-based business, got introduced to the technology he was 30 years old. That was when he went to the United States in 1994. His friends said “He says that he came to know that there was a thing called a computer, only when he was 33.”

Ma founded Alibaba with a 17 friends in 1999 in his apartment in Hangzhou. Today, Alibaba’s headquarters in Hangzhou is a model of modern workplace – a campus style flexible open-plan office space that accommodates some 9,000 Alibaba employees.

The driving message of Ma and the Alibaba Group’s story is about overcoming failures and learning from them.

Ma failed his university entrance exam three times. Ma said when Kentucky Fried Chicken came to China, he applied for employment. There were 24 of them applicants. The 23 were accepted except him.

He said he has applied for admission in Harvard University 10 times and was never accepted. The five- feet- tall economic giant said, “Someday I should go teach there (Harvard) maybe”.

Ma related that he got the idea of naming their company Alibaba while he was in a coffee shop in San Francisco. “Suddenly I thought Alibaba is a good name. The waitress comes, and I asked her, ‘Do you know about Ali Baba?’ She said, ‘Open sesame.’ So I went out onto the street, asking 10, 20 people. They all knew about Ali Baba. I decided it was a good name. Plus, it starts with A, so it’s always on top.”

Like in the Arabian Nights tale that when the woodcutter Ali Baba uttered the magic word “Open Sesame, ” the cave opened and revealed the stolen loot of gold and other riches, when one clicks at Alibaba.com, one is led to a variety of merchandises. Not stolen though.

Ma, in a letter to Alibaba stockholders, said “We firmly believe the era of heavy business conglomerates is gone. The economy of today and tomorrow will rely on a platform and ecosystem approach. Sustainable growth can only be achieved when enterprises operate within an ecosystem, participate in collective development and share common interests.”

That’s what APEC is all about about.